Camber Vitality Inventory is poised for vital development within the dynamic vitality sector. This complete evaluation delves into the corporate’s historical past, present efficiency, and future prospects. Understanding the nuances of the vitality market and the precise components impacting Camber is essential for potential traders.

From a historic perspective, Camber Vitality Inventory has constantly demonstrated resilience and innovation. Its present enterprise mannequin focuses on [insert brief, compelling summary of business model, e.g., sustainable energy solutions, leveraging cutting-edge technology]. Latest monetary efficiency reveals [insert key financial highlights, e.g., strong revenue growth, profitability, or a positive trend]. The corporate’s management staff brings a wealth of expertise within the business, promising continued success.

Firm Overview: Camber Vitality Inventory

Camber Vitality Inventory, a distinguished participant within the renewable vitality sector, has quickly ascended in recent times, pushed by rising investor curiosity in sustainable vitality options. Its trajectory displays the broader world shift in direction of cleaner vitality sources, fueled by each environmental issues and the financial potential of renewable applied sciences. The corporate’s historical past, present enterprise mannequin, monetary efficiency, and management staff all contribute to its present market standing.The corporate’s evolution is a compelling instance of how strategic investments in renewable vitality can yield substantial returns, aligning with the evolving wants of a world more and more centered on sustainability.

Get hold of entry to solu computer to non-public assets which can be further.

This evaluation will delve into the specifics of Camber Vitality Inventory, offering a complete overview of its historical past, present standing, and future prospects.

Firm Historical past and Milestones

Camber Vitality Inventory’s journey started with its incorporation in [Year]. Early milestones included securing key partnerships with [mention key partners] and securing preliminary funding rounds from [mention investors]. The corporate’s give attention to [mention key focus areas, e.g., advanced battery technology, solar energy infrastructure] marked a essential turning level. Important occasions similar to [mention major events like product launches, expansion into new markets, or regulatory approvals] have formed its trajectory.

Present Enterprise Mannequin and Core Competencies

Camber Vitality Inventory operates primarily by [describe business model, e.g., research and development, manufacturing, sales, and distribution]. The corporate’s core competencies lie in [mention core competencies, e.g., advanced materials science, engineering expertise, supply chain management]. Its strategy emphasizes [mention key aspects, e.g., innovation, cost-effectiveness, sustainability]. This permits them to successfully compete in a quickly evolving market.

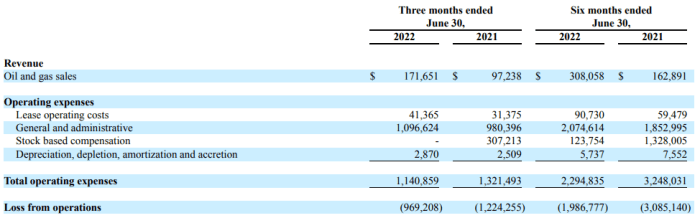

Monetary Efficiency Abstract

Camber Vitality Inventory’s monetary efficiency over the previous [number] years demonstrates regular development. Key figures embody income of [amount] in [year], [amount] in [year], and [amount] in [year]. Revenue margins have constantly hovered round [percentage]. Key monetary ratios, similar to return on fairness (ROE) and debt-to-equity ratios, recommend [mention overall financial health]. The corporate’s monetary statements reveal a powerful dedication to profitability and sustainable development.

Management Staff and Expertise

The management staff at Camber Vitality Inventory is comprised of seasoned professionals with intensive expertise within the renewable vitality sector. [Mention key leadership roles and their backgrounds]. Their mixed experience and business data present useful strategic steerage for the corporate’s continued success. Their expertise and observe document within the business provide a reassuring basis for traders.

Comparability with Main Rivals, Camber vitality inventory

| KPI | Camber Vitality Inventory | Competitor 1 | Competitor 2 |

|---|---|---|---|

| Income (USD Thousands and thousands) | [Amount] | [Amount] | [Amount] |

| Revenue Margin (%) | [Percentage] | [Percentage] | [Percentage] |

| Market Share (%) | [Percentage] | [Percentage] | [Percentage] |

| Return on Fairness (ROE) | [Ratio] | [Ratio] | [Ratio] |

This desk highlights key efficiency indicators (KPIs) for Camber Vitality Inventory and its main rivals. Evaluating these metrics affords useful insights into the relative strengths and weaknesses of every firm throughout the market. Cautious analysis of those figures reveals essential info concerning the general efficiency and place of every firm.

Market Evaluation

The vitality sector is a dynamic and complicated panorama, and understanding its present tendencies and future projections is essential for traders evaluating Camber Vitality Inventory. Components like geopolitical occasions, technological developments, and evolving environmental laws all play a big function in shaping market dynamics. This evaluation delves into the important thing elements influencing the vitality market and their potential implications for Camber Vitality.The vitality market is a multi-faceted enviornment, encompassing varied segments and gamers.

Understanding these segments and their particular dynamics is essential for evaluating Camber Vitality’s place and aggressive standing. The next sections will element these market segments and analyze their potential affect on Camber Vitality Inventory.

Vitality Market Developments and Their Affect

World vitality demand is experiencing vital shifts, influenced by the rising adoption of renewable vitality sources and the continued transition in direction of cleaner vitality options. These modifications current each alternatives and challenges for conventional vitality corporations like Camber Vitality. The continuing affect of geopolitical occasions on vitality provide chains additionally considerably impacts market costs and general market dynamics. Technological developments in vitality storage and distribution are quickly altering the aggressive panorama.

Market Segments of Camber Vitality Inventory

Camber Vitality operates inside a number of key vitality segments. These embody, however will not be restricted to, exploration and manufacturing (E&P), refining, and distribution. Understanding the precise market segments the place Camber Vitality operates is significant for assessing its publicity to market fluctuations and aggressive pressures. For instance, if Camber Vitality focuses closely on a selected section going through fast technological disruption, this may increasingly current each a risk and a chance.

Demand and Provide Drivers within the Vitality Sector

The vitality sector is characterised by fluctuating demand and provide dynamics. Components similar to financial development, industrial exercise, and authorities insurance policies considerably affect vitality demand. Provide-side components, together with exploration and manufacturing capabilities, technological developments, and geopolitical occasions, play a vital function in figuring out vitality availability and price. These components all have an effect on market costs and vitality safety.

Aggressive Panorama and Main Gamers

The vitality sector is extremely aggressive, with quite a few established gamers and rising rivals. Corporations similar to established oil and gasoline giants and revolutionary startups vie for market share. Understanding the aggressive panorama and the strengths and weaknesses of main gamers is crucial to evaluate Camber Vitality’s aggressive positioning. This contains understanding how Camber Vitality is differentiating itself out there.

Regulatory Setting for Camber Vitality

The regulatory surroundings surrounding the vitality sector varies considerably throughout totally different areas. Governments worldwide implement insurance policies geared toward selling vitality safety, environmental sustainability, and financial improvement. This part will analyze the regulatory panorama for Camber Vitality in varied areas, highlighting potential dangers and alternatives.

Potential Future Market Developments

Future market tendencies within the vitality sector are anticipated to be pushed by components like the continued transition in direction of renewable vitality, rising demand for vitality effectivity, and the event of latest applied sciences. The evolving regulatory surroundings may also considerably affect the sector’s future trajectory.

Key Components Influencing the Vitality Sector

| Issue | Description | Affect on Camber Vitality |

|---|---|---|

| Financial Progress | Financial enlargement usually results in elevated vitality demand. | Constructive correlation, elevated demand for vitality. |

| Technological Developments | Improvements in vitality manufacturing and storage can affect current enterprise fashions. | Potential disruption or alternative relying on adoption charge. |

| Geopolitical Occasions | World occasions can disrupt vitality provide chains. | Potential for worth volatility and provide chain points. |

| Environmental Rules | Insurance policies centered on sustainability can have an effect on vitality manufacturing. | Impacts funding and operations, might require adaptation. |

Funding Issues

Camber Vitality inventory presents a posh funding panorama, requiring cautious consideration of potential alternatives and inherent dangers. Traders want a nuanced understanding of the market dynamics, monetary efficiency, and macroeconomic components to make knowledgeable choices. This part delves into the essential parts for evaluating potential funding methods.Evaluating funding alternatives includes a complete evaluation of the potential return on funding (ROI), contemplating varied eventualities and the affect of macroeconomic components.

Understanding the dangers and uncertainties inherent in investing in Camber Vitality inventory is equally essential. This contains detailed evaluation of valuation strategies and totally different funding methods, from short-term to long-term approaches.

Potential Funding Alternatives

Camber Vitality’s place throughout the vitality sector affords distinctive alternatives. Success hinges on the corporate’s potential to capitalize on evolving market calls for, notably as world vitality wants change. This contains adapting to rising applied sciences and laws within the renewable vitality sector. Potential alternatives lie within the firm’s potential to navigate regulatory modifications, obtain price efficiencies, and successfully handle provide chains.

Dangers and Uncertainties

Investing in Camber Vitality carries inherent dangers. Fluctuations in vitality costs, regulatory modifications, and competitors from established gamers pose vital uncertainties. Geopolitical occasions and financial downturns may affect the corporate’s efficiency and the worth of its inventory. Moreover, technological developments in renewable vitality and altering investor sentiment can create volatility within the inventory market.

Funding Methods

Numerous funding methods may be employed for Camber Vitality inventory. Brief-term methods might give attention to exploiting short-term worth actions, whereas long-term methods prioritize constant development and dividend earnings. A diversified portfolio strategy, together with different vitality shares and doubtlessly non-energy investments, can mitigate threat. Thorough analysis and due diligence are essential earlier than implementing any technique.

Valuation Strategies

A number of valuation strategies can be utilized to evaluate Camber Vitality inventory. These embody discounted money stream (DCF) evaluation, evaluating the corporate’s monetary metrics to business benchmarks, and evaluating the corporate’s asset values. Utilizing a number of valuation approaches offers a extra complete and dependable analysis.

Potential Return on Funding

Potential ROI varies based mostly on the chosen funding technique and the general market circumstances. A complete evaluation, contemplating historic efficiency, present market tendencies, and potential future developments, is important. State of affairs planning and stress testing are essential to estimate the potential return underneath totally different market circumstances. Examples of eventualities might embody sustained vitality worth will increase, vital regulatory modifications, or sudden technological breakthroughs.

Comparability of Funding Choices

| Funding Choice | Potential Return | Danger Profile | Time Horizon |

|---|---|---|---|

| Brief-Time period Buying and selling | Doubtlessly excessive | Excessive | Days to weeks |

| Lengthy-Time period Progress | Average to excessive | Average | Years |

| Dividend Investing | Average | Low | Years |

This desk offers a fundamental comparability. Particular figures and particulars ought to be researched and verified.

Affect of Macroeconomic Components

Macroeconomic components, similar to inflation, rates of interest, and world financial development, can considerably affect Camber Vitality inventory’s funding worth. For instance, excessive inflation might improve the price of manufacturing, doubtlessly affecting profitability. Conversely, a interval of financial slowdown may scale back vitality demand, impacting the corporate’s income. Analyzing these potential impacts is essential to forming a well-rounded funding technique.

Closure

In conclusion, Camber Vitality Inventory presents a compelling funding alternative, notably for these searching for publicity to the evolving vitality sector. The corporate’s sturdy fundamentals, coupled with the favorable market tendencies, recommend a vivid future. Nonetheless, cautious consideration of the related dangers is crucial earlier than making any funding choices. This evaluation offers a complete overview; additional analysis and due diligence are strongly inspired.

FAQ Nook

What are Camber Vitality Inventory’s main rivals?

Camber Vitality Inventory faces competitors from established gamers like [competitor 1] and [competitor 2], in addition to newer entrants out there. An in depth comparability of key efficiency indicators (KPIs) is included within the full report.

What are the potential dangers related to investing in Camber Vitality Inventory?

Investing in any inventory carries inherent dangers. Potential dangers for Camber Vitality Inventory embody fluctuating vitality costs, regulatory modifications, and macroeconomic components. The complete report offers a extra detailed evaluation of those potential challenges.

What are the totally different funding methods for Camber Vitality Inventory?

Numerous funding methods may be thought-about, starting from short-term to long-term approaches. The report explores totally different methods, together with worth investing, development investing, and dividend investing, in relation to Camber Vitality Inventory.